Most Recent Planning & Investing Articles

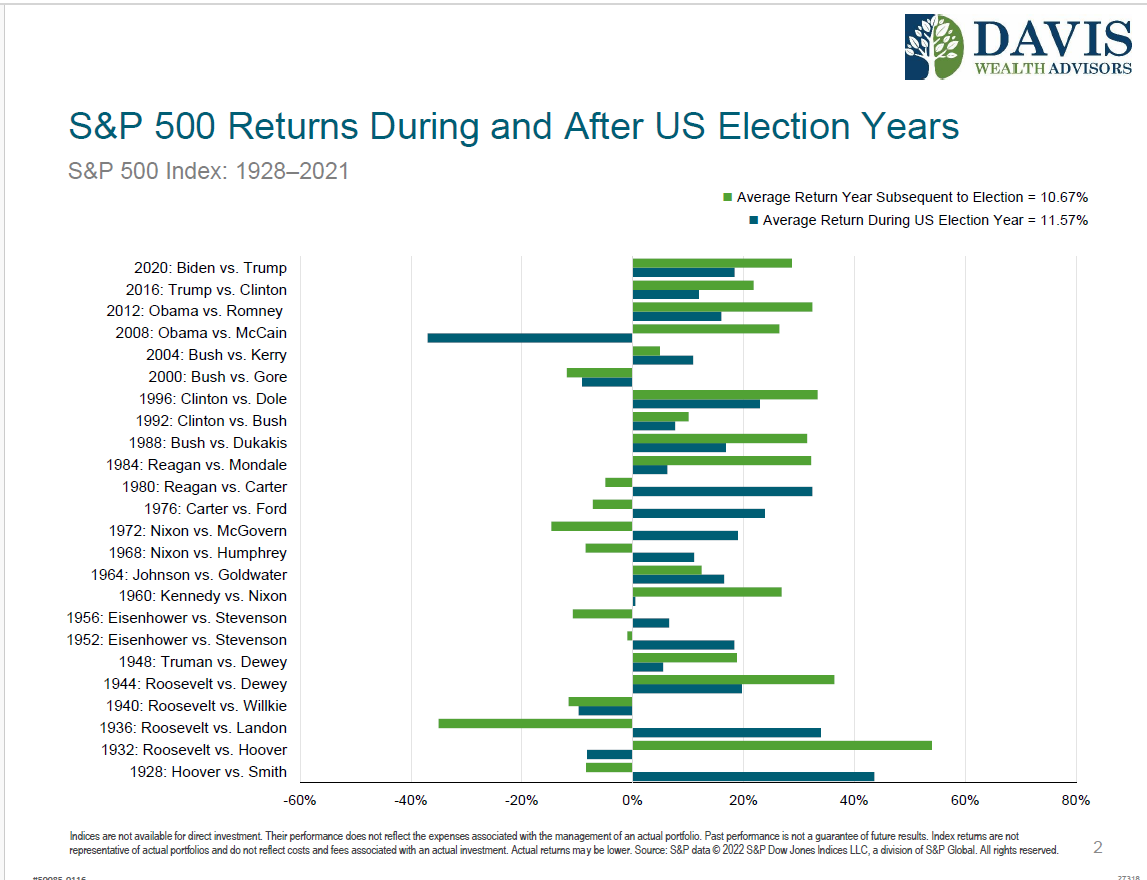

Stock & Bond Returns During Election Years

The SECURE 2.0 Act, which was passed in December 2022, made a significant change to the IRS catch-up contribution rules. The catch-up contribution allows those aged 50 and above to contribute an additional $7,500 to an employer-sponsored pre-tax retirement plan.

The Roth-Only Catch-Up Contribution Rule Will Get Time to Catch Up

The SECURE 2.0 Act, which was passed in December 2022, made a significant change to the IRS catch-up contribution rules. The catch-up contribution allows those aged 50 and above to contribute an additional $7,500 to an employer-sponsored pre-tax retirement plan.

Secure 2.0 Act

Late last year, Congress enacted a new slate of legislature entitled, somewhat unimaginatively, the SECURE 2.0 Act. The intent of this new Act is to increase retirement savings by increasing the various ways to save across the ages.

Are I Bonds Right for You?

We have received many questions regarding I bonds this year, and for good reason. They are likely a good option [...]

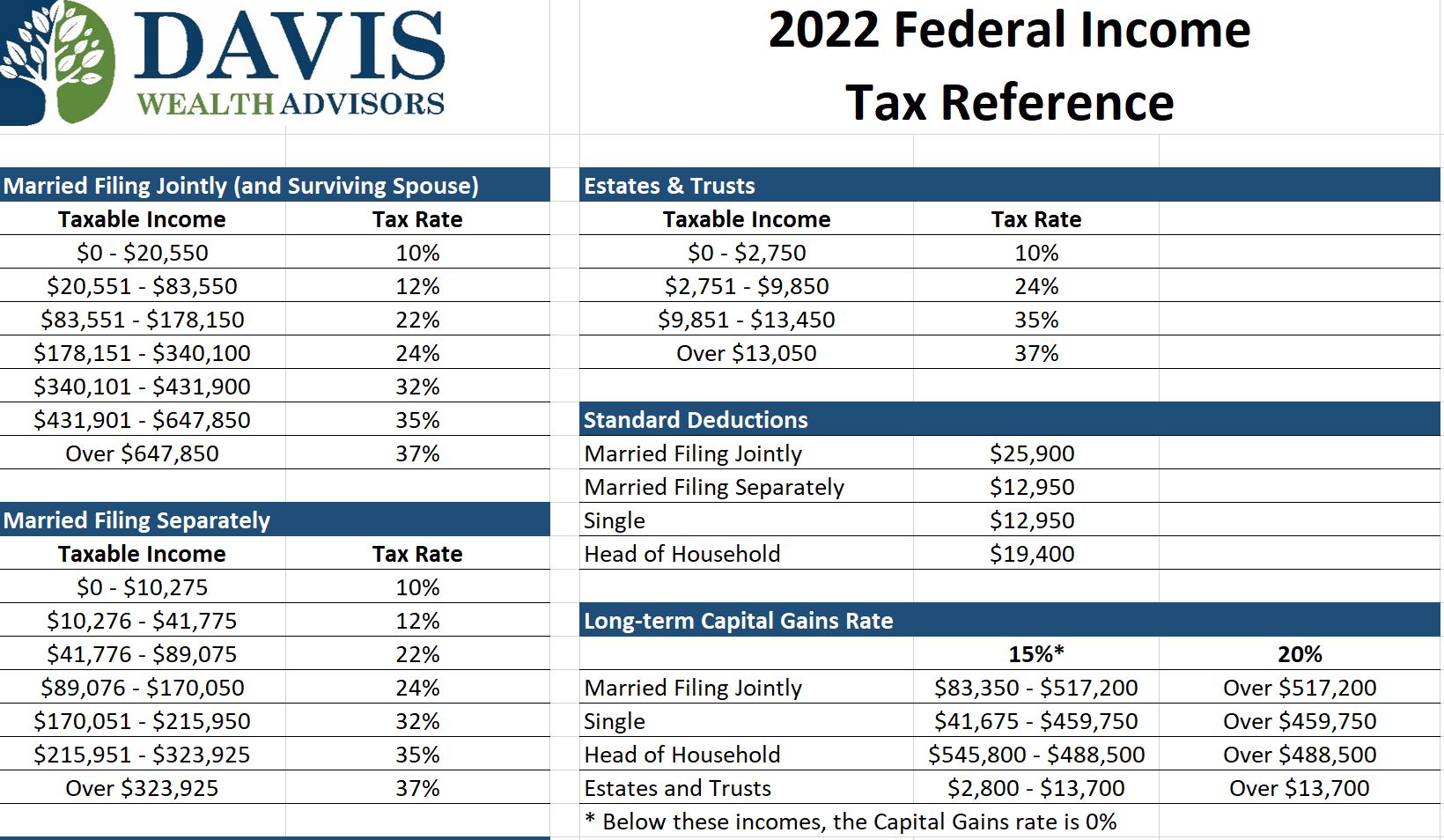

2022 Contribution Limits & Tax Reference

Click here to view and download our 2022 Contribution Limits & Tax Reference Guide

Q3 2021 Market Review Slides

Click here to view the Q3 2021 Market Slides.