June Recap and July Outlook

The Fed finally hit “pause” on interest rate increases in June after fifteen months and ten consecutive rate hikes. The “dot-plot” indicated that Fed officials think two further increases may be necessary in 2023, and it’s become clear that it is only a brief pause. “Hawkish pause” is the way it’s being framed, and the Fed minutes released on July 5 indicate that while rate hikes may not happen at the pace we’ve seen, most FOMC members are in agreement that even tighter money supply is necessary to bring inflation to heel.

There are some signs that the rate increases already enacted are beginning to have an impact, such as the June non-farm payroll report, which hit below consensus estimates for the first time in 15 months. The 12-month CPI has continued to decline and was reported at 3% for the month of June. However, wage growth remains strong.

The threat of an impending recession weighed on markets during most of the first half of the year, but the timeline of a recession continues to be extended. The market sentiment for this pending recession shifted swiftly over the first few weeks of July. Earlier in the year, a summer recession was projected, but now the timing of any potential recession is pushed out to 2024 – if at all! The Fed is scheduled to meet next week, July 25-26th, and it is expected that they will increase rates another 25 basis points and then likely will be on pause again.

Recent data we’ve been watching:

- 12-month CPI was 3.0% in June. The Bureau of Labor Statistics reported a monthly increase of 0.2%

- The ISM Services Index rose to 53.9 in June. A reading above 50 indicates an expansionary environment. Services are a strong driver of the economy

- June non-farm payrolls of 209,000 missed estimates. The Bureau of Labor Statistics report was the lowest monthly number in 2 ½ years

What does the recent market data mean for the timing of interest rate decreases? The Fed continues to posit that a recession can potentially be avoided, and the enduring strength of the economy is making that look more plausible. Fed Chairman Powell is on record with his belief that it will take until 2025 for inflation to recede back to acceptable levels. If the economy continues to remain strong, avoiding a recession all together or experiencing a mild recession, interest rate decreases could begin in 2024.

Not everything is responding to Powell’s attempts to slow the economy. Housing accounts for 35% of CPI, the biggest category by far. While renting costs are declining, the rent is still too darn high for many. It is, however, cheaper than owning. With mortgage rates recently climbing above 7%, the gap between the cost of owning and renting is larger than at any time since 2000, according to John Burns Real Estate Consulting.

The health of the consumer will be under close watch this fall, especially with the resumption of student loan payments due in October. We’ll be monitoring the impacts of these additional cash flow burdens, coupled with the implications of higher-for-longer interest rates, high housing costs, and rising consumer credit card debt.

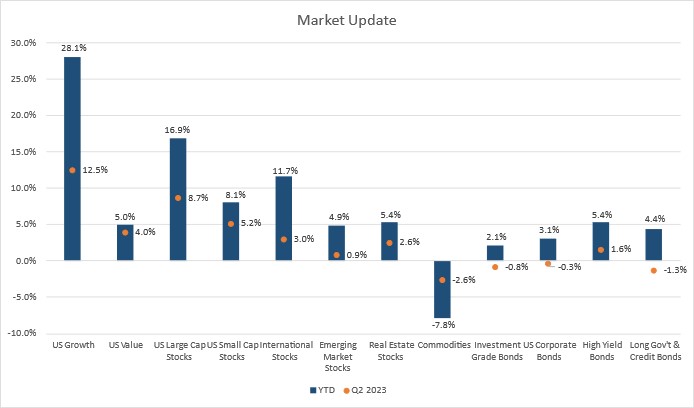

Quarterly Market Update: Returns at a Glance

Source: Bloomberg Finance L.P., Haver Analytics, Fidelity Investments Asset Allocation Research Team as of 6/30/23.

US stocks, especially large growth stocks, staged a surprisingly strong rally for the 1st half of the year. While a number of individual tech stocks were responsible for this strong rally – Apple, Meta, Nvidia – other equity sectors also made healthy gains. For Q2, the S&P 500 gained 8.7%, the MSCI EAFE Index grew 2.95%, and the MSCI Emerging Markets Index returned 0.9%.

While bonds have positive returns year-to-date, they struggled to maintain those gains in the 2nd quarter of the year. Higher yields are cushioning the returns, but continued questions about the health of the economy and the path of interest rates created more volatility in bonds over the last quarter. The US Aggregate Bond Index finished Q2 with a return of -0.8%. Higher risk bonds that are more closely linked to stock market activity, like emerging market bonds and high-yield bonds, were the only bonds that had positive returns for the period. Bond volatility may continue as investors adjust to higher interest rates for longer than anticipated since a recession has been pushed out further. As an example, we saw the 10-yr US Treasury bond yield spiked to over 4% following the July 12th CPI print, though it has recently settled back down to about 3.85%.

For more information on market performance and outlook, please review our Quarterly Investment Update.

The Smart Investor

The Federal Reserve Bank of New York reported that consumer credit card debt is at almost a trillion dollars – $988 billion, to be exact. This is an increase of 17% over last year. This is something to watch over the coming months.

As we have been meeting with clients, we have heard that spending is higher, largely due to inflationary pressures and increased travel spending. We’ve been revising financial plans accordingly. The mid-year point is a good time to take stock of current finances, make sure goals are on track, and identify any areas of stress or potential shortfalls. Here are some questions to consider:

- Have your goals changed? Lining up your current financial situation with long-term goals is critical to achieving them.

- Budgeting isn’t fun – but staying on top of expenses keeps lifestyle creep at bay and identifies problems before they get bigger.

- What are you doing with your cash? It’s not just a volatility buffer anymore; cash is generating returns. Consider where you are holding it and potentially make changes. Fidelity is paying 4.79% on cash balances now and short-term CDs are fetching 5%+.

Summer is a great time to relax and enjoy all the reasons you work as hard as you do. However, your money shouldn’t be taking any vacations – it needs to keep working so you can eventually stop. Checking in and ensuring you’re making good choices will keep you moving closer to your goals. Let us know if we can be of any help!