Mid-September, Democrats and the House Ways and Means Committee released their proposed tax changes in the budget reconciliation bill known as the “Build America Back Better” act. This legislation will now be debated in Congress, and I expect we will see changes before it is finalized. Here is a summary:

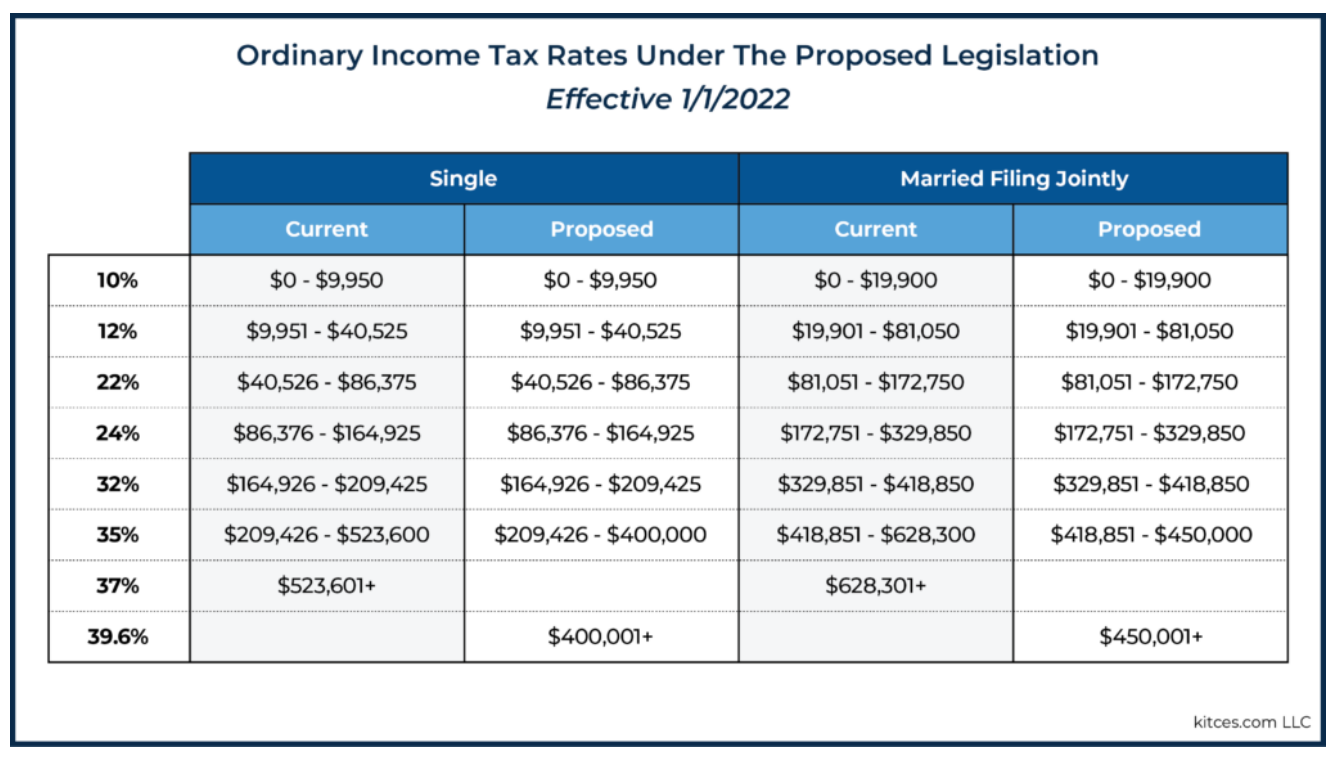

- The top marginal tax rate of 39.6% has been restored, replacing the 37% bracket, and the income needed to reach the top bracket has been lowered to $400,000 for individuals (previously $523,600) and $450,000 for couples (previously $628,300). This change means taxpayers in the $400,000 – $500,000 income range will be impacted the most if this is passed.

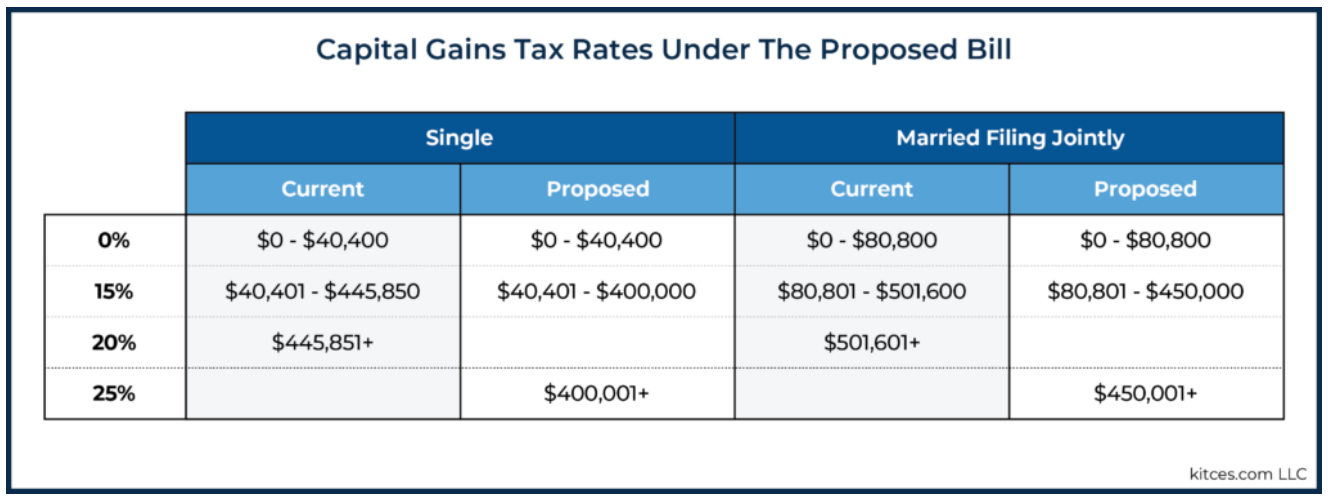

- The top capital gains rate is increasing from 20% to 25%, which is lower than what was originally proposed. This will be retroactive, beginning for any gains after September 14th, with a few caveats for deals that are in the making but haven’t closed.

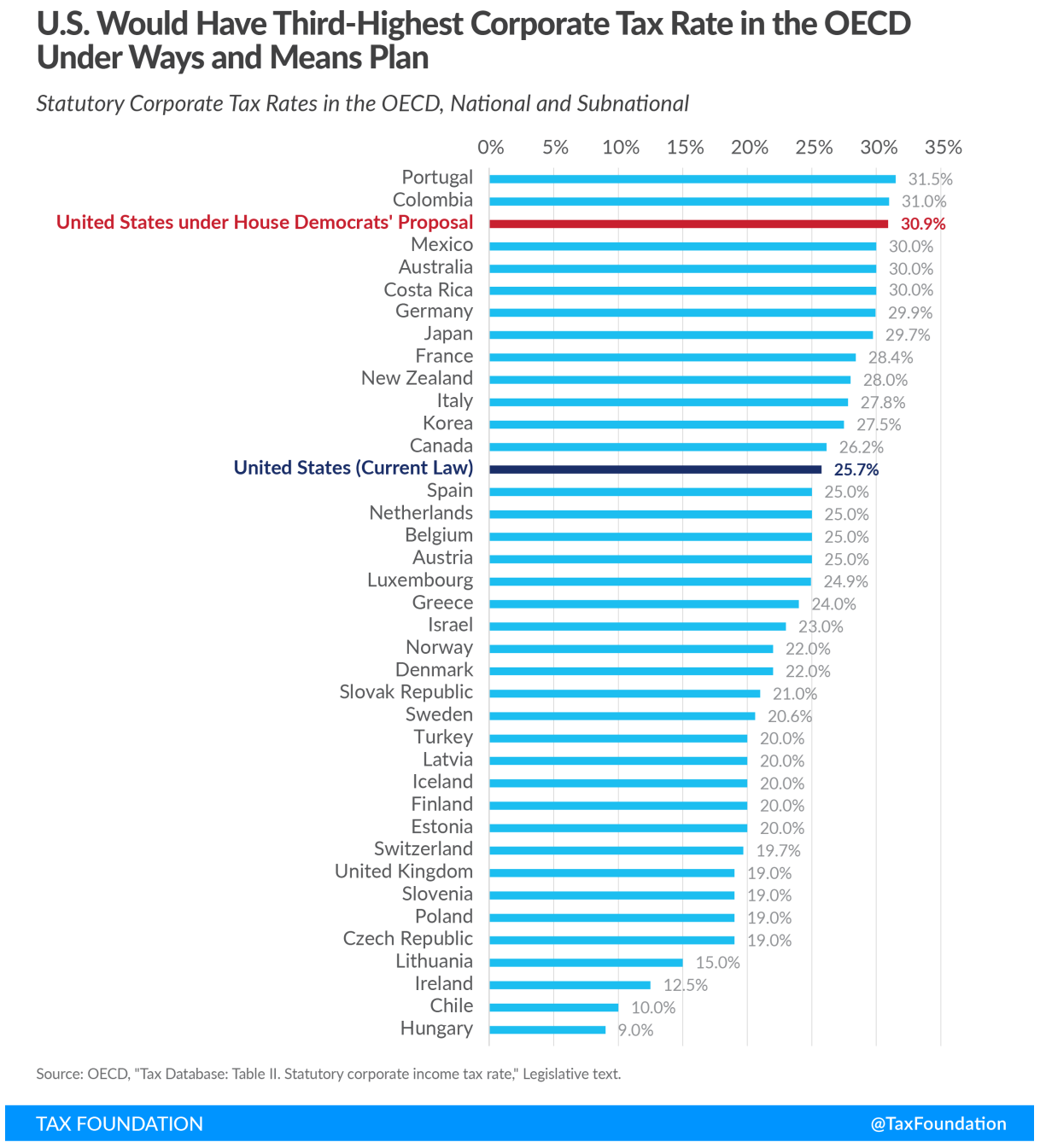

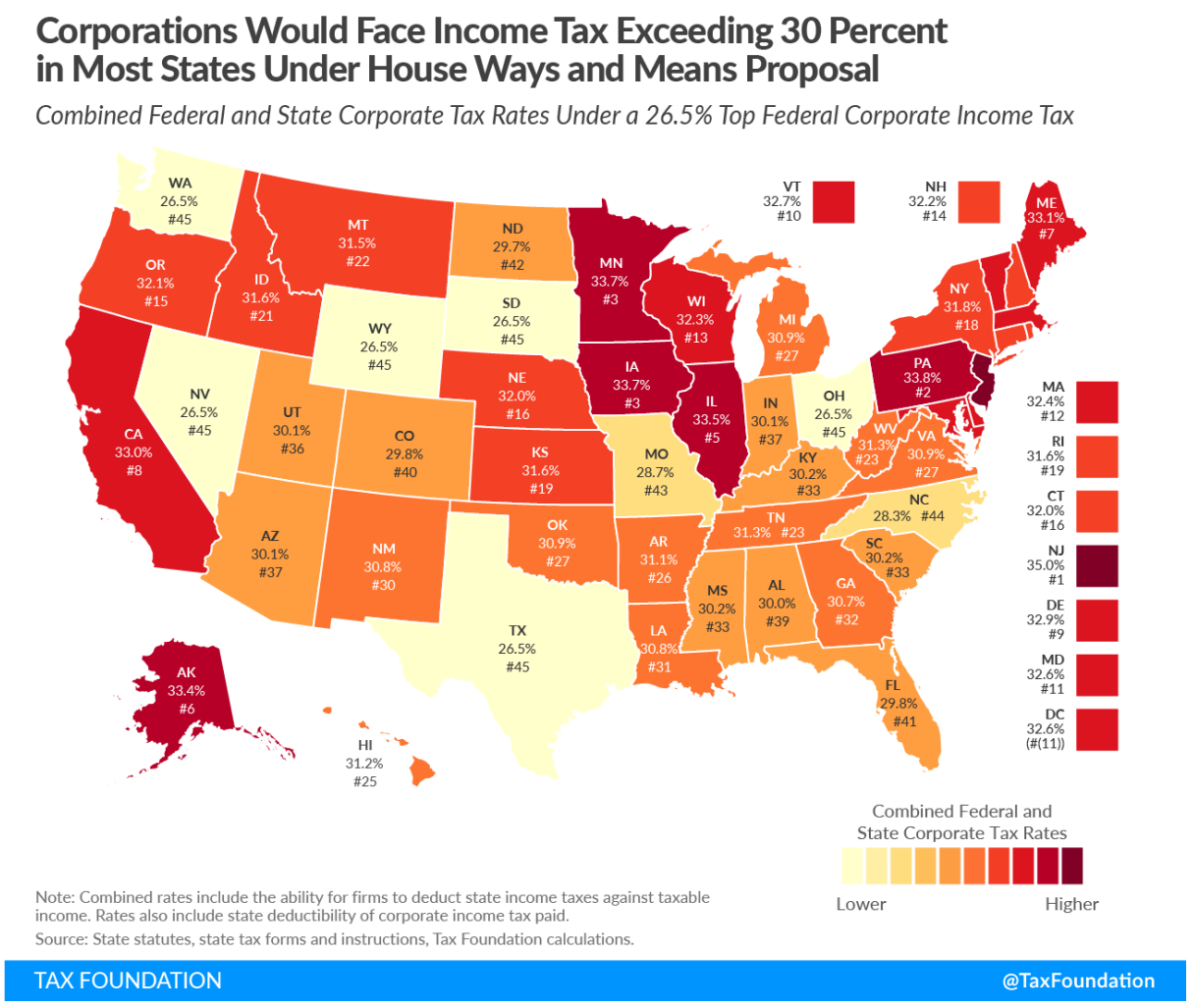

- Top Corporate tax rate increases from 21% to 26.5%. The flat tax rate of 21% also becomes a graduated tax rate, starting at 18% on the first $400,000 of income and increasing up to 26.5% on income above $5M.

- The Section 199A deduction for Qualified Business Income would now have an income cap of $400,000 for individuals and $500,000 for joint filers on the maximum amount of the deduction a taxpayer can claim.

- The 3.8% Net Investment Income Tax (NIIT) has been expanded to include S Corporation owners

- The federal estate tax exemption is expected to be reduced back to where it was before the Tax Cuts and Jobs Act, to around $6M for 2022.

- Roth conversions will be prohibited for individuals with taxable income of more than $400,000 and married couples with taxable income of more than $450,000. There is a 10-year phase- out, so this would begin after Dec. 31st, 2031.

- There is a 3% surtax for ultra-high earners with over $5M of income.

- New Required Minimum Distributions for taxpayers with retirement accounts that total between $10m-$20M and taxable income greater than $400,000 for single filers and $450,000 for joint filers.

New Top Ordinary Income Tax Rate

As seen in the chart below, the 35% marginal bracket becomes substantially compressed, particularly for married taxpayers. Previously, married taxpayers had over $209,000 (from $418,851 – $628,300) of income in the 35% bracket. The proposed changes would leave only $31,149 in the 35% bracket.

New Top Long-term Capital Gains Tax Rate

The proposed capital gains tax change increases the highest rate from 20% to 25% while lowering the income needed to reach the higher rate by about $50,000. This is lower than what had been previously discussed, which was taxing capital gains at ordinary income tax rates for those earning more than $1M. See the details in the chart below.

The Capital Gains change would go into effect immediately, impacting any long-term gains incurred on or after September 14th. That said, a narrow but important exception is included in the proposal that would exempt gains from certain existing binding contracts from the higher 25% rate. To qualify for the exception, the binding contract must:

- Have been entered into on or before by September 13, 2021.

- Be in writing.

- Cannot be modified in any “material respect” after September 30, 2021).

- Close before the end of the year (the sale must occur in 2021).

Qualified Business Income Deduction

Biden originally talked about eliminating the QBI deduction for taxpayers with income in excess of $400,000. Instead of eliminating the deduction altogether, the bill would simply cap the maximum amount of the deduction a taxpayer can claim. The maximum allowable QBI deductions would be as follows:

- Single filers – $400,000

- Joint filers – $500,000

- Trusts and estates – $10,000

Net Investment Income Tax to High-Income S Corporation Owners

Under current law, profits of S corporations are subject to neither employment taxes (e.g., FICA taxes, Self-Employment Tax), nor the Net Investment Income Tax (NIIT). The proposed change would impact an S corporation owner after their Modified Adjusted Gross Income (MAGI) exceeds their applicable threshold ($400,000 for single files and $500,000 for joint filers). At that point, S corporation profits will be added together with ‘regular’ investment income to produce something the bill calls “Specified Net Income.” And ultimately, the greater of either the owner’s net investment income or Specified Net Income will be subject to the 3.8% surtax. A phase-in range of $100,000 will be used to determine how much of the S Corporation profits are subject to the 3.8% surtax.

Here is an example shared on www.kitces.com which illustrates how it would work.

Angela is a high-income S corporation owner. In 2022, she had $430,000 of MAGI, of which $200,000 is attributable to S corporation profits and $20,000 is attributable to ‘regular’ investment income. Here, Angela’s $200,000 of S corporation profits will be added to her $20,000 of ‘regular’ investment income, giving her $220,000 of “Specified Net Income.” Furthermore, since Angela is $230,000 over the $200,000 MAGI threshold for the 3.8% surtax applicable to single filers, all $220,000 of her Specified Net Income (the lesser of her Specified Income and ($220,000) and her MAGI in excess of her applicable 3.8% surtax threshold ($230,000)) is potentially subject to the 3.8% surtax.

However, Angela’s $430,000 of MAGI puts her squarely within her phase-in range of $400,000 – $500,000. As a result, an additional step is needed to determine how much of Angela’s income will actually be subject to the NIIT. More specifically, if all of Angela’s S corporation profits were included in the calculation of the 3.8% surtax, Angela’s surtax liability, due to the inclusion of that income, would have increased by $200,000 x 3.8% = $7,600. However, since Angela is ‘only’ 30% of the way through her threshold, her S corporation profits can only increase her NIIT tax liability by a maximum of $7,600 x 30% = $2,280. Altogether, Angela would have $3,040 of income subjected to the 3.8% surtax ($2,280 plus 3.8% x $20,000 of ‘regular’ investment income = $3,040).

Top Corporate Tax Rate Rises

According to Tax Foundation (taxfoundation.org), an independent tax policy non-profit, “Under the proposal, the top combined corporate income tax rate would reach 30.9 percent in the United States when including the average state-level corporate income tax. Companies in 21 states and D.C. would face a higher corporate tax rate than in any country in the Organization for Economic Co-operation and Development (OECD), where Portugal currently levies the highest tax rate of 31.5 percent. New Jersey would see the highest combined federal-state corporate tax rate of nearly 35 percent.”

Disclosure: Nothing contained herein shall constitute an offer to sell or solicitation of an offer to buy any security. The information provided here is general and intended as for informational purposes only and should not be used as the primary basis for a financial or investment decision. This article is intended to be informative, Material in this publication is original or from published sources and is believed to be accurate. However, we do not guarantee the accuracy or timeliness of such information and assume no liability for any resulting damages Davis Wealth Advisors is not a CPA firm, please discuss with your CPA exactly how it might impact you. If you would like to set up a time to discuss these changes, please reach out to us at team@daviswealthadvisors.net.

References:

Kitces Blog article “Analyzing Biden’s New American Families Plan Tax Proposal” Sept. 15, 2021: https://www.kitces.com/blog/biden-american-families-plan-bill-proposed-increase-tax-capital-gains-retirement-reform/

Tax Foundation www.taxfoundation.org