November Recap and December Outlook

We’re on the home stretch of a year in which “unprecedented” doesn’t even begin to capture it. Nothing went according to plan, for anyone, from Russia’s invasion of Ukraine to the Fed’s domestic attempts to combat inflation. Along the way, we saw spiking gas prices, tanking equity and bond markets, a continued red-hot labor market, a head-scratcher of a mid-term election, and a broad and deep meltdown of crypto.

While stubborn resistance has succeeded beyond all hopes for the Ukrainians, intransigent inflation has resulted in a series of interest rate increases that we will only know the impact of sometime in 2023. Any one event had implications for everything else, and the intertwinement was perhaps exemplified by a year in which equities and bonds were largely locked in a Texas two-step.

The one thing we seem to be able to count on is increased volatility and uncertainty.

The Predictive Limits of Data

Let’s get into the data:

- The November non-farm payroll number was 263,000. The report from the Department of Labor was an increase over the October number but has remained in a tight band for the last three months.

- 12-month CPI was 7.7% in October. The BLS reported that the increase was the smallest 12-month advance since January 2022.

- The second estimate of third-quarter GDP came in at 2.9%. The Bureau of Economic Analysis reported that the higher number reflected upward revisions to consumer spending.

- A record 196.7 million Americans shopped during the Thanksgiving retail period, according to the National Retail Federation. This is up by 17 million over 2021.

What Does All of That Data Add Up To?

In short, it’s Powell’s worst nightmare. Inflation isn’t really “trending” down yet – it’s just declining a little bit. A still-hot labor market and a confident consumer mean that the economy is proving stronger than previously thought.

While that’s good news right now, the problem is that at some point, the 375 basis point increase in the key short-term rate enacted so far this year – plus a likely 50 basis point increase still to come in December – will begin to take effect. Powell continues to caution that rate increases have a lagging economic impact. This makes it extremely difficult to gauge how high rates should go and how fast they should get there.

Adding another layer of difficulty is hyper-sensitive equity market sentiment. Powell’s challenge is that if he pauses on rate increases to give the data time to catch up, the market may interpret it as a sign that increases are over and a boom will result. Which of course, would keep things at fever pitch instead of allowing the economy to cool off enough to bring inflation down.

Powell’s recent guidance on rate increases is that overall rates may need to go higher than originally thought but that the amount of the monthly increase may go down. This may not be enough to avoid a recession in 2023, but the underlying strength of the economy may mean that a recession would be shallow and short.

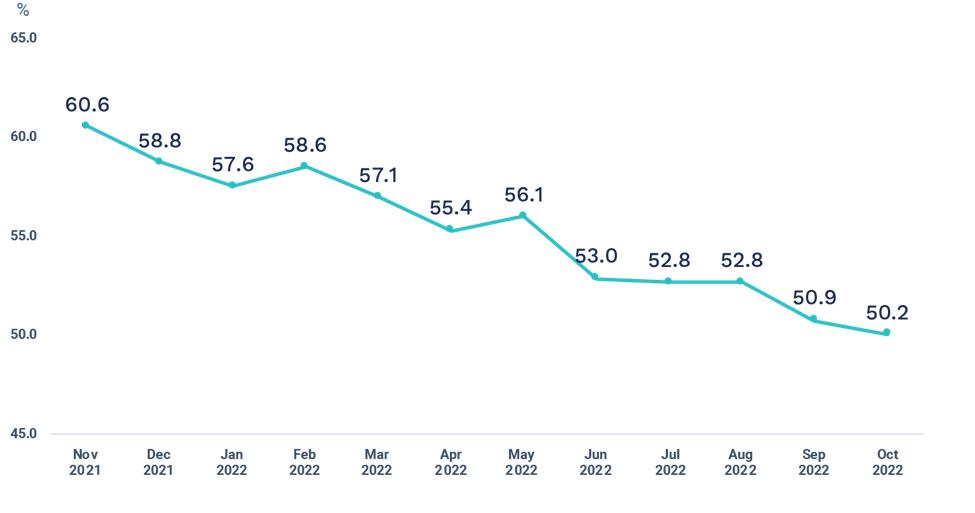

Chart of the Month: A Key Manufacturing Index Continues to Show Expansion

The Institute for Supply Management reported that “The U.S. manufacturing sector continues to expand, but at the lowest rate since the coronavirus pandemic recovery began.”

Source: Institute for Supply Management

Equity Markets in November

- The S&P 500 was up 5.38%

- The Dow Jones Industrial Average gained 5.67%

- The S&P Mid-Cap 400 returned 5.95%

- The S&P Small-Cap 600 increased 3.98%

Source: S&P. All performance as of November 30, 2022

Earnings reports are 97% in, and Q3 is turning out better than expected. Reporting is complete for 486 issues, of which 68.9% beat expectations. Q3 2022 is expected to post an 8.0% gain over Q2 2022 and be down 2.7% compared to Q3 2021.

Volatility remained high. The prospect of a potential end to Fed rate increases in early 2023 is driving positive sentiment. The remaining rate increase in December, and Powell’s comments, will likely impact where markets end up.

Bond Markets

The 10-year U.S. Treasury ended the month at 3.61%, dropping from 4.05% in October. The 30-year U.S. Treasury ended November at 3.74%, down from 4.17% last month. The Bloomberg U.S. Aggregate Bond Index ended November with a return of 3.68%. The year-to-date return at month end was -12.62%.

The Smart Investor

The expectation for a recession in 2023 is increasing, with Bloomberg reporting a median forecasted probability of recession of 62.5% as of November 1.

How can investors position themselves to navigate through sustained volatility, the potential for a recession, and the likelihood that the double burden of increased prices and higher interest rates will persist into 2023?

There are still some things you can do in 2022:

• Max out 401k, HSA, and other tax-efficient savings

• Complete charitable giving before year-end

• Don’t forget your RMD, or complete a qualified charitable distribution to offset it

• It’s not too late for tax-loss harvesting

For 2023, the best approach is to start the year off ahead of the game:

• Set budgets for holiday spending and stick to them

• Start the process of revisiting cash flow planning

• Rethink big expenditures – can they wait until prices and interest rates decline?

The holiday season is a time for wonder, joy, and relaxation. But the new year will be with us soon, and spending some time thinking through what you want to accomplish, whether it’s a savings goal, investing, family giving, or a big purchase, is a good exercise to get you excited about the planning process.